Powerful and proactive analytics provide the compass we need to navigate this crisis.

Can you forecast without data?

I’ve seen several opinions lately that analytics-based hospitality solutions are rendered irrelevant by the current situation. And there’s the notion the pandemic’s unpredictable impact on the travel industry has made the hotel revenue management system (RMS) a “blank slate.”

However, Forbes’s recent article shows analytics and BI projects are bucking the trend, stating “49 percent of enterprises are either launching new analytics and BI projects or moving forward without delay on already planned projects.”

The global hotel industry has seen high levels of cancellations and no-shows, a steep decline in new reservations, and aggressive rate cuts as hotels compete for the limited remaining demand. In response, today’s sophisticated RMS must be calibrated to help hotel businesses understand:

- The volume and value of demand

- Booking patterns

- A fair market price (what guests are willing to pay), sensitivity and competitor pricing impacts

The Challenge for Hotels

Most analytics approaches employ traditional forecasting techniques that rely on the availability of valid historical data. For outlier periods (often called “Special Events”), an RMS typically relies on a historical instance of a similar special event as the basis of the demand forecast, patterns and pricing behavior.

Given the current situation, most traditional forecasting approaches will entail one or a combination of these measures:

- Smooth out the trend using all historical data

- Reduce forecasts as rooms cancel or less rooms are sold than expected

- React to the trend being observed gradually over time

These techniques lead to over-forecasting in the disruption period and may result in demand being turned away where demand is sparse and being slow to react and produce appropriate controls as demand recovers. Reacting poorly to the demand creates controls that will not produce good revenue outcomes.

What IDeaS Is Doing Differently

The current situation we face is not a short period of anomalous demand, like a concert—which sounds pretty great right about now—and it’s not a trend. This is a unique period of disruption (of unknown duration) requiring quick action to understand and adapt to “the new normal.”

At IDeaS, our focus in our RMS platforms has been to enable the system to serve as your reliable radar, reacting quickly to produce appropriate controls during the disruption and observing and responding as business begins to recover.

We recognize the recovery trajectory will vary for individual properties within a market. For example, two adjacent hotels—one predominantly filled with domestic business and another with mainly inbound demand—will recover differently. Therefore, we have taken steps to leverage key analytics capabilities to react quickly to what is really happening and ignore irrelevant data.

Ignoring Irrelevant Data

There is a delicate balance to strike. It’s important that an RMS excludes data from the demand disruption and doesn’t use it to forecast the recovery period. At the same time, the RMS must be able to see the evidence of disruption and that the recovery has begun.

IDeaS systems have been refined to ignore the period impacted by COVID-19 as follows:

Short-term: ignore pace data from the disrupted period.

Pace data helps the RMS understand booking patterns, the fair market price and price sensitivity.

- Excluding pace data from the disrupted period avoids the unusual booking activity (higher levels of cancellations and no-shows, lower levels of reservations, and unusual pricing practices). In this phase we will not exclude the final business performance, allowing the RMS to react quickly where there are signs of recovery.

Longer-term: ignore all data from the impacted period and through the recovery period.

- This will ensure your RMS entirely ignores the disrupted period and only learns from the new business performance of a property, post disruption and recovery.

Reacting to “The New Normal”

The process of ignoring certain periods of historical data may imply the RMS is starting from scratch. This is where having 13 or ideally 23 more months of history helps the system ensure it is well-positioned to quickly adjust as business drops and react to signs of recovery. IDeaS has several specific features which support this:

Reacting to significant shifts in demand: IDeaS has designed functionality to handle unique conditions observed in travel demand. Demand can be seen to shift between business types, for example when a hotel introduces a new advanced purchase product and business shifts out of the flexible product and into the advanced purchase product (or vice versa). Or, demand can shift aggressively up or down when there are overall changes in demand, such as during a refurbishment. IDeaS is leveraging this functionality to react quickly to changes in the recent past.

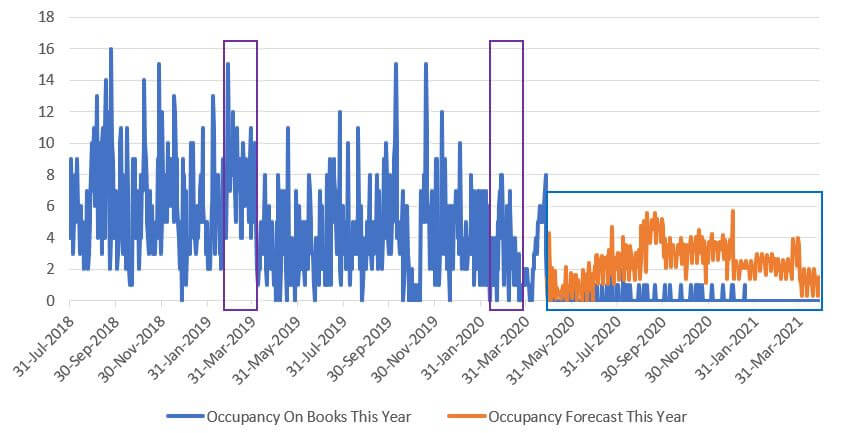

The RMS must decide if these changes are regular for this season or exceptional. In the graph below, for example:

- It will compare the same season in 2019 vs. 2020 (or multiple years if available) and ensure the reduction in occupancy is not a standard seasonal drop.

- Where it detects this significant drop is not a seasonal change, the RMS will see this as a significant business drop and adjust future forecasts accordingly.

Business on the books: We have increased the sensitivity of the RMS to changes in business on the books that deviate from the expected volume of demand (deviation from the calibrated booking curve—e.g., I expected to have 20 rooms on the books but only find 5).

Changes in patterns: Overall trends and changes are observed at each recalibration. As a result, the RMS can react as booking patterns, market pricing and price sensitivity changes.

Pricing: IDeaS solutions are designed to price optimally, even in times of very low demand, ensuring the price selected is relative to the level of demand and the price sensitivity. The RMS will calibrate competitors’ typical impacts on demand and react appropriately. This is important to ensure the RMS continues to select competitive pricing as hotels compete more aggressively for remaining demand and it avoids “a race to the bottom.”

It is not yet clear how the pandemic will unfold for markets, and IDeaS’ solutions will regularly recalibrate to ensure they react appropriately as conditions change and additional data becomes available. The IDeaS team recognizes the ongoing impact this uncertain situation has on the hospitality and travel industry and continues to review the impacts on our clients’ properties.

Our greatest focus at this time is to ensure our solutions and services are well positioned to support clients in reacting, adjusting and, as the dust settles, finding the new magnetic north for your property and market. Thank you for taking the time to read this. We wish you, your colleagues, families and friends continued health and happiness in this difficult time.

For a downloadable version of this blog, click here.

For additional details on how IDeaS applies high performance analytics, please see our blog: Analytics is the Real Performance Driver for Hotel Revenue Management. And for additional resources and guidance from IDeaS’ industry experts, please visit our COVID-19 hotel industry hub.