Using different revenue management systems can seem similar to selecting a different type of vehicle to drive. Last year, you were driving a standard Chevy model, but today you’re driving a shiny new Ford. Both vehicles ultimately drive you to your final destination, but you’re likely to notice differences in how smooth of a ride that they each provided. With the potential of only minor cosmetic differences or bells and whistles, what would happen if you decided to prop the hood up and take a peek inside?

Words like “big data” and “analytics” have become important themes in our industry’s discussion around the makeup of powerful revenue management tools; however, data modelling should not be overlooked as one of the essential analytical components of any revenue management system’s engine performance.

To discuss how data modelling drives optimal performance within an RMS, I sat down with Dr. Ravi Mehrota, president and chief scientist at IDeaS Revenue Solutions.

EW: “How does an RMS use data modelling and why is a ‘good’ model important?”

RM: “Revenue management systems use data modelling to define, organize and analyze the data necessary for revenue management and price optimization. There are a lot of considerations to be given when determining the right type of model framework for a price optimization and revenue management system.

Data models provide an important description of the complexities of the business process. Many models use parameters that are calibrated from the input data. The output is a result that can then be optimized. This makes a ‘good’ model an absolutely critical component for strong RMS performance.”

EW: “Can you walk me through a simple model? Perhaps one that demonstrates demand as a function of price?”

RM: “Absolutely! For our example, let’s use the historical pricing and corresponding rooms sold to model a simple relationship between demand and price. Of course, keep in mind that other significant effects like seasonality, market trends, competitors, etc. must also be considered to isolate this price and demand relationship. The output of this model with its inherent uncertainty can be used to maximize the expected revenue and thus produce an optimal price.

Let’s look at a simple model that we often use to explain the concepts for price optimization.

In this case, we will look at four steps:

- Input data (historical price & rooms sold at that price) used for calibration of the model;

- Calibrate the model parameters to forecast a specific price demand model;

- Maximize the revenue based on the model; and

- Output the optimal price based on the maximized result.

Step 1: We start with the input data:

| Historical Price/Rate | Rooms Sold |

| 35 | 40 |

| 40 | 44 |

| 47 | 42 |

| 51 | 48 |

| 58 | 45 |

| 65 | 57 |

| 70 | 59 |

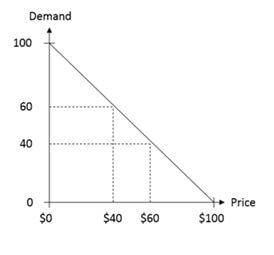

Step 2: We can, for the purpose of this example, build a simple linear relationship between price and demand as a forecast for a future date (Note to the readers: IDeaS uses proprietary price modelling – not to be confused with this example):

The figure above is the model, and we can see the price-demand relationship. If a price of $40 is offered, the expectation is to sell 60 rooms. Similarly at $60, 40 rooms are expected to be sold.

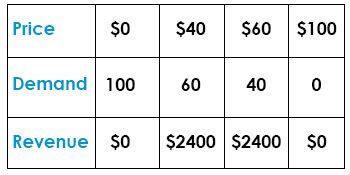

Below we can see price, demand and its corresponding revenue:

With this model, we can compare the future day with different price points. A price of $60 is expected to capture a demand of 40 rooms, equating out to a revenue of $2400. Similarly, a price of $40 is expected to capture a demand of 60 rooms, also adding up to a revenue of $2400. This leads us to the most important question: What is the optimal demand/price combination?

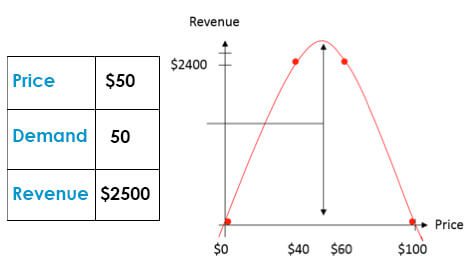

Step 3: In this simple example, an optimal price (using dynamic pricing) is the price that maximizes revenue. Looking at the illustration below, we can see that with a price of $50, we expect to have 50 rooms, equating to $2500.

Step 4: In this case, $50 is the optimal price.”

EW: “So through the right model, we are able to identify when demand as a function of price is most optimal and when it begins to have adversative results?”

RM: “Yes, the ‘right’ model provides us with a structure that can then be further optimized with powerful analytics that drive optimal performance and pricing.”

EW: “Is there a ‘best’ way to perform price optimization?”

RM: “Real time price optimization is a good example of a real world problem for which stochastic models are well-suited, and deterministic linear or nonlinear programming are the wrong answer due to the statistical nature of the real world business problem that cannot be effectively incorporated into the deterministic programming framework.”

EW: “How does the data model support this process?”

RM: “The job of a modeler is to understand the real world of price optimization where the demand is a function of myriads of variables including price and the real demand is not deterministic, the market is intrinsically somewhat indeterminate, and there is uncertainty associated with any forecast of demand.

We therefore need a price optimization model that enables us to maximize expected profits in this uncertain world while coping with the risk associated with the uncertain nature of the demand and the marketplace. How do we go about selecting an appropriate price optimization model for the real world pricing problem? The chosen model could range from a very simple model through to a model that tries to encapsulate every aspect of the real world. In effect, there are an infinite number of models that could be selected within this range, each with a different content. The question a modeler needs to answer is: Which model is best?”

EW: “How is a revenue manager equipped to address this complex topic?”

RM: “Selecting a revenue management solution comes down to trusting the power that’s underneath its hood. You should be confident that your RMS’s engine has been fine-tuned for every possible condition to drive total revenue performance.”

EW: “Thanks, Ravi. As always, you have the ability to make this all sound so very simple.”

RM: (Laughs) “You’re very welcome, Elizabeth.”

Some people choose their vehicles on the basis of its size, their cosmetic preferences or the inclusion of heated leather seats. All of these preferences are important contributors to the driver’s satisfaction and are necessary considerations in the selection process. But as an experienced driver, you should also take the time to focus on your vehicle’s capability for total performance and peer at the power underneath its hood.

If you think about it, any car that you choose to drive is ultimately only as good as its total performance. The same holds true with your revenue management systems. Today’s revenue systems offer us intuitive user-friendly designs, innovative interfaces, customized reports and dashboards, and useful functionality. Propping up their hoods is where the market becomes truly divisive.

Analytical capabilities is where our market is divided into good analytics and GREAT analytics. Good analytics get the job done, but GREAT analytics truly optimize based upon your hotel’s strategy, competitors, trends, etc. and make you more revenue. This is why data modelling is an integral part of an RMS’s analytical engine.