Consulting Services answers recent client questions about hotel revenue management

As 23:00 GMT on 09 March 2019 and Great Britain’s scheduled departure from the European Union looms large, hospitality businesses are understandably anxious about the impact for their sector. With huge numbers of EU nationals working in hotels—countless European contracts and deals affected—coupled with the UK’s appeal to inbound tourism all up in the air, forecasting the impact of Brexit is under growing scrutiny as the deadline draws inexorably closer.

In a recent report on industry trends, Will Hawkley, global head of leisure and hospitality, KPMG, highlighted some key factors that arguably further complicate the Brexit outlook:

- The industry is consolidating with more merger and acquisition activity as a strategy for growth

- The consumer is changing with more value placed on immersive experiences as well as stabilising consumer confidence, which generally leads to increased leisure spend

- Technology is driving innovation, crucial to improving customer experience through segmentation and personalisation

Projections are further clouded when you overlay this with some of the socio-economic triggers of Brexit. UK consumer spend, hit by the weak value of the pound, shows a trend in shorter holidays and so-called ‘staycations’ becoming increasingly appealing. Add to the mix the wage stagnation, this has seen reductions in disposable income with certain demographics, resulting in hotels and restaurants frantically menu engineering to drive spend.

This also coincided with the hottest summer on record in the UK (and parts of Europe) this year, with many climate-change forecasts indicating this is the new norm and outbound UK holidaymakers might be looking closer to home in future. The pound’s slide of course conversely means a spike in inbound tourism, with deals to be had. VisitBritain research showed that demand for staycations was up 4% last year and expected to be higher in 2018/19.

Not to be underestimated is the issue of staffing. The hospitality industry is predisposed more than most to dependence on EU nationals to service their customers. While transient personnel staff for operational positions has always been part and parcel of hotel life, there are legitimate fears arising around ‘brain drain’ with deficits in commercial positions, like revenue management.

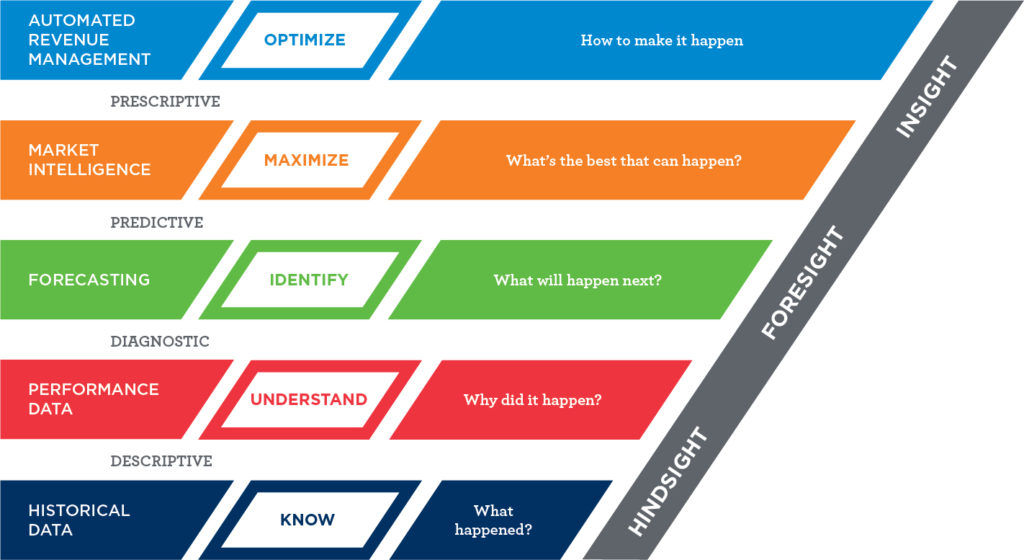

Against this uncertain backdrop, hoteliers are doubling down on their evaluation of their people, processes and, more than ever, technology, to manage the risks posed by the economic anxiety Brexit has brought. With increased challenges around forecast accuracy and performance, the subject of ‘futurecasting’ has been brought sharply into focus.

Futurecasting is the practice used in many different industries to strategically plan for an organisation’s future. It evaluates underlying industry dynamics, predictive analysis and a variety of strategies to help develop an insightful vision of the future. So how can we apply this effectively to revenue management in the hotel world? With the risks (and to be bipartisan, the opportunities) possibly arising from an event like Brexit, hotels are looking at this approach to make a more informed view of the future, to plan intelligently and make profitable decisions throughout their organisation.

It also lends itself well to support the industry’s ever-growing obsession with customer journey, consumer centric productization and personalisation, as Will Hawkley at KMPG alluded to in the Brexit report.

To add some brevity to this gloomy outlook, this quote from celebrated anthropologist Andrew Lang perfectly encapsulates the damage sub-optimal forecasting capabilities create: “An unsophisticated forecaster uses statistics as a drunken man uses lampposts—for support rather than for illumination.”

Using data intelligence most associated with futurecasting has the helpful consequence of aligning sales, marketing, e-commerce and digital teams and strategies, moving us into the realm of prescriptive ‘what-if’ analysis, for key decision-making on big plays, campaigns, promos, group business and, ideally, the utopia of true ‘management by exception’ across departments.

So let’s look at an example of this type of data. Here’s an illustration of how folding in travel-intelligence data can help:

- Target key inbound markets

- Compression in the marketplace

- See trends in the market sooner

- Improve forecast efficiency with more relevant data

Let’s focus and zoom in on another example of futurecasting-style data. By adding segmented market demand data, we can much better understand a hotel’s position in the marketplace. This leads to:

- Improved forecast accuracy

- Driving more profitable direct bookings

- Creating a more optimal channel and segmentation strategy

Ultimately, events like Brexit are difficult to accurately forecast and many of the implications are still unknown, as with any unprecedented event of this nature. But hotels can insure themselves against the impact and mitigate some of the risk by evolving and future-proofing their forecasting capabilities with techniques like futurecasting. Take a minute to evaluate your own business—are you innovating in these areas:

- Prescriptive analytics

- Travel-intelligence data

- Cookie and web analytics

- Adaptive machine-learning

- Market demand data

- Channel/cost performance

Last week, the governor of the Bank of England, Mark Carney shared some gloomy projections for the UK economy in the event of a ‘no-deal’ Brexit, or continued impasse with the negotiators in Brussels. Hoteliers and revenue managers should take some comfort that, unlike most politicians and economists, there are tools available to bolster forecast capabilities, with predictive and prescriptive analytics. But man and machine still need to work in harmony to overcome forecasting challenges.

To leave you with a quote from Brian David Johnson, former futurist at Intel: “Futurecasting is about looking 10 to 15 years out. It’s a mix of social science and computer science, statistical and economic data, and then a lot of conversations. So I always start with humans.”

- Total Revenue Forecasting Is Coming…Rome - July 13, 2021

- Can Hotel Revenue Management Ever Satisfy a Finance Leader’s Forecast & Budget Demands? - September 16, 2020

- Bed & Brexit – Can Futurecasting Help Hoteliers Accommodate the UK’s Bumpy Departure? - December 5, 2018