After 100 months of growth, how long can we keep the good times rolling?

- We are in the second longest RevPAR growth cycle in history, but…

- GDP growth could come to a grinding halt by 2020

- So how will the hotel industry fare?

The annual Hotel Data Conference, held in Nashville, Tennessee, traditionally kicks off the busy third-quarter conference and meeting schedule. Well-timed with the annual budget planning cycle, it attracts a record number of thought leaders and experts in revenue management, pricing, distribution and other hotel-industry “data nerds.”

As would be expected from a data conference, there was no shortage of graphs, charts and tables to feast on during the day (and lots of BBQ to feast on at night). Amidst sessions about the (almost traditional) bashing of online travel agencies—“are they good or bad for the business?”—and a number of sessions trying to address the vexing question of sluggish growth of ADR (answer: “it’s complicated”), two slides, out of hundreds presented during the conference, have stuck with me:

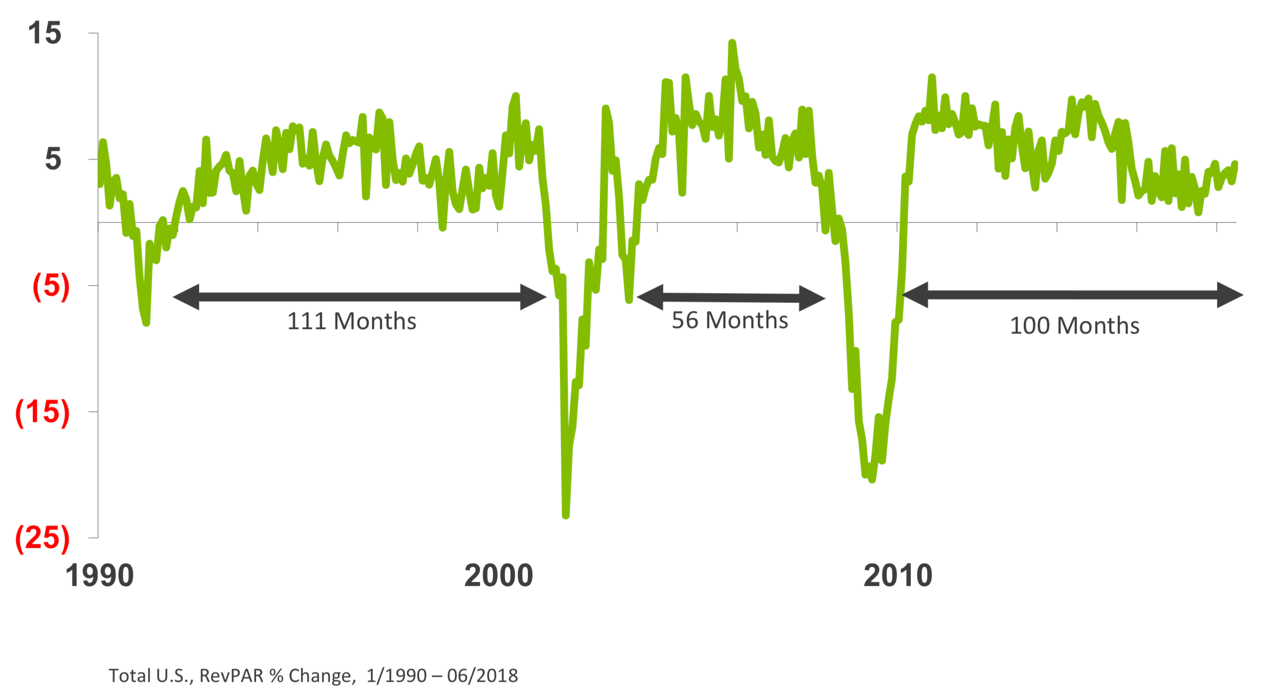

Exhibit 1: We are approaching close to 100 months of uninterrupted RevPAR growth in the US (graph courtesy of STR). We are in the second longest growth cycle in history (or at least since STR has measured RevPAR) with over eight years of uninterrupted growth. 11 months to go until the US hotel industry beats the 111-month record set in 1990 to 2000. The industry has changed dramatically in the last eight years, and it’s a testament to its resiliency to see this 100-month milestone approaching. Time to celebrate!

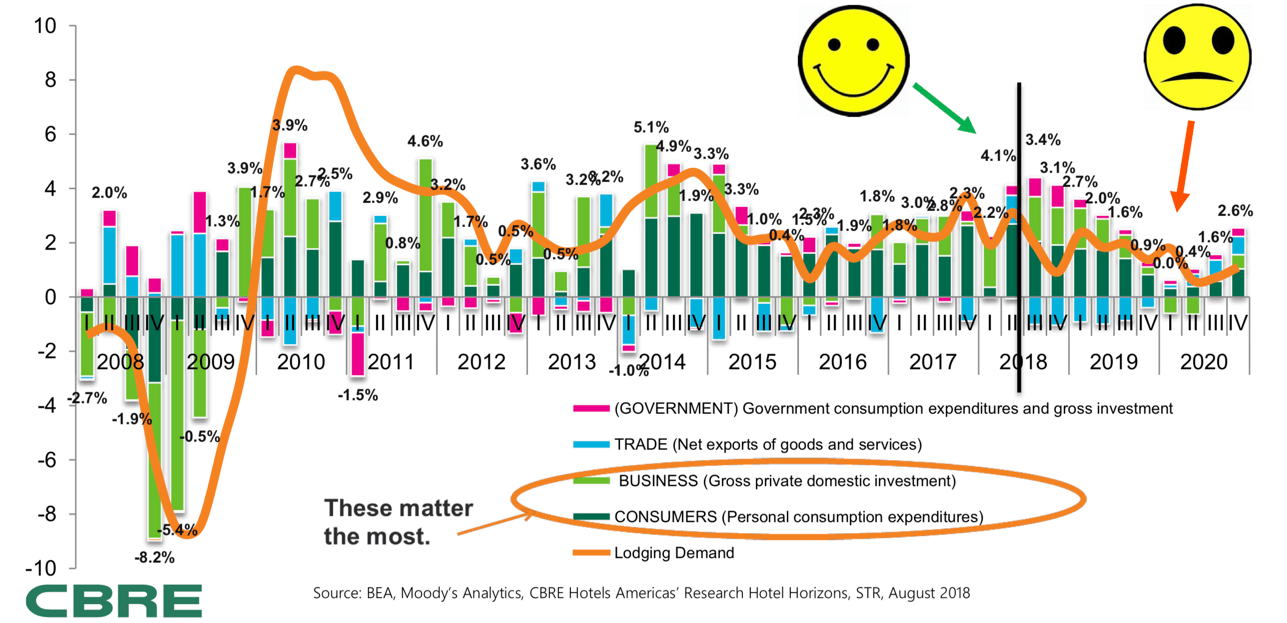

Exhibit 2: An economic forecast by CBRE’s Mark Woodworth (smileys courtesy of CBRE). Firstly, it is pretty exceptional to see how smooth the US economy has been sailing along since Q2, 2014. While growth zigzagged from 2011 to 2013, it has been steady since early 2014, chugging along nicely. All smiles abound so far. Well, hold your BBQ, Nashville. It seems we have reached the peak pretty much right now, and it’s all downhill from here. If the forecast is right, GDP growth will slow down to 0% by Q1, 2020.![]() With GDP being a leading indicator for the hotel industry, lodging demand (the orange line in the graph) will be close to 0% by Q2 of the same year. And what happens after that is anyone’s guess.

With GDP being a leading indicator for the hotel industry, lodging demand (the orange line in the graph) will be close to 0% by Q2 of the same year. And what happens after that is anyone’s guess.

This is not the first presentation I have seen recently pointing to a slowdown in or around 2020. Some economists now put the risk of a recession in 2020 at 50%. Vanguard, one of the world’s largest asset management firms has recently moved its probability of a recession in 2020 from 10% to 30-40%.

With STR predicting 2.9% RevPAR growth and 2.6% ADR growth for 2019, the signs for the next 12 months are still optimistic. However, if both prove correct, it would be the lowest growth in five years. And the growth will not be as widespread as before (STR predicts eight markets to show declining RevPAR growth next year).

All good times must come to an end. Will it be a short break or the end of the party? A slowdown or a showdown? I don’t know, but what I do know is that it is far from certain that the good times will keep rolling. What any sensible revenue manager should do right now is plan for a slowdown, update worst-case scenarios, and be prepared so there are no surprises when the party comes to an end.

As I speak at and attend a number of conferences throughout the coming months, I will observe and compare the various economic forecasts and share any emerging consensus or conclusions.

Stay tuned.

- On Discovery, On Distribution, On Data & Analytics – with Kalibri Labs - December 10, 2020

- Unconstrained Conversations – An IDeaS Podcast - April 16, 2020

- Welcome to the Future - January 23, 2020